Welcome back retailers! Please take a careful look at this week’s issue as it covers a critical subject for all of us.

If you have not subscribed yet, join 8,000 other subscribers and hit the button below. We mail All Things Retail once a week on Tuesdays, and we ensure each issue is filled with a bunch of actionable content. So, hit the button, it’s FREE >>>

Retailers Beware!

As you should know by now, there is a full-blown triple whammy that may be impacting you today and most likely will create serious headwinds as we get deeper into the second half of the year, including the holiday selling season. The combination of shipping delays out of Asia, dramatically increased costs for those shipments, and general inflationary pressures has created a set of challenges which must be understood, planned for, and aggressively acted upon. While there are no silver bullets, there are ways to make a bad situation a bit better. Some ideas are listed below. But before that, let’s start with some positive news!

The Good News

Research firm Mood Media just published a report on consumer sentiment and it’s very bullish in terms of spending in general and the return to physical shopping. We already know that mall traffic is back. An example: according to PREIT, during the month of May, traffic on average throughout their portfolio exceeded 90% of May 2019 levels. Five standout properties generated traffic of 105% of 2019 levels and continue to outperform 2019 today. We can expect more to come based on the Mood Media research.

Check out these highlights:

“The majority of consumers expect their shopping habits to be back to pre-pandemic levels by or before the end of this year.”

“Four in five (80%) of global consumers said they feel ‘comfortable” returning to physical stores.”

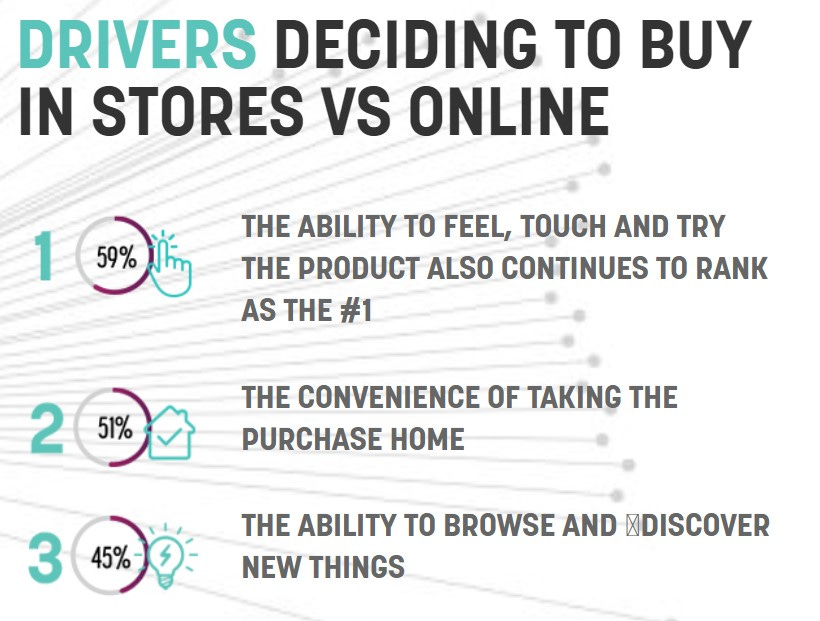

Consumers clearly have reasons for shopping in physical stores and they are eager to return to them. “This new study validates what we are seeing and hearing every day – both online and offline play an important role in retail, oftentimes in harmony with one another. That balance is now returning with solid foot traffic in shops around the world.”

“The report looked at what global shoppers missed most about the physical shopping experience during lockdown. Nearly half (45%) said the experience of ‘touching and trying on’ items on the spot was what that they missed most when stores were closed.”

“The fun and social experience of shopping with friends and significant others is the second most missed aspect of physical shopping (35%), tied with the opportunity to bring the purchase home immediately at 35% as well.”

“Consumers have also enjoyed the merging of physical and digital, with 33% of them citing plans to continue using Click and Collect/BOPIS (Buy Online, Pickup In-Store) services beyond the pandemic, with U.S. consumers above the global average at 38%.”

“The percentage of respondents reporting an uptick in their spending compared to before the pandemic has increased from 23% in September 2020 to 29% in June 2021.”

This study, along with plenty of other data points, clearly shows that physical retail, done well, is alive and well. Hopefully, each of you are enjoying this resurgence. If not, you may want to check out some past issues of All Things Retail.

The Troubling News

As retail momentum begins to build, there are troubling headwinds that every retailer (and manufacturer) will need to understand and address. Supply chain delays and dramatically increasing costs (some public comments reflect spending as much as $15,000 - $20,000 for a 40’ container) along with general cost and pricing pressures have created a difficult environment for the remainder of this year and potentially well into 2022/2023. According to ING, “there are five reasons why supply chain Armageddon may continue into 2023, including imbalances in supply/demand, few alternatives to ocean freight, continued port congestion due to labor shortages, imbalances in recovery rates by country, and higher rates of cancelled sailings”.

So, how can you react to these challenges and mitigate their impact? Here are some thoughts:

Raise Prices: this one is obvious, but tread carefully. Don’t do across-the-board increases, as each item has its own elasticity. Study your assortment and determine where you have the most pricing flexibility (some items/ categories can in theory increase by 10% or more while others should not increase at all). Be tactical vs. reacting in broad strokes. Study your competition as well (they have the same headwinds as you do) to ensure you are making decisions that allow you to maintain your competitive positioning against them.

Protect Margins: We discuss margin improvement in Issue #7 of All Things Retail. Now its more important than ever to protect every penny from both a gross margin and net margin perspective. In addition to the guidance in Issue #7, can you safely reduce promotional markdowns (and related ad spend) without impacting traffic and revenue? Can new loss prevention initiatives be easily put into place to reduce theft (internal and external)? Can payroll be reduced by a few hours a day or week? When was the last time you did an expense spend review to identify savings opportunities? If you are buying through a distributor, can any items be shifted directly to the manufacturer at lower costs? All savings will add up to help offset the impact of these headwinds.

Support Your Suppliers: addressing these multiple challenges will require teamwork. Your suppliers are fighting all the same issues that you are. Work with them to find solutions rather than thinking of them as an adversary. Provide better product need forecasts to them to assist with their planning. Stretch those forecasts out for several months if possible. Also understand that payment terms are changing, and your suppliers are most likely fronting more cash to their providers than ever before. If they come to you to pay more upon order placement and/or shipment confirmation, work with them to support this request. We all know that cash is king, and you should never cut your working capital below a predetermined safety level, but helping your suppliers to the extent reasonable will ultimately benefit your business.

Plan Your Business: you must develop an understanding of not only the cost increases you may be burdened with, but also the shortages of available product (both delays in arrival times and items/ quantities you will not receive at all) that you may experience. This understanding should then be correlated to your sales revenue planning (can you hit your planned sales with hypothetically 15% less inventory?), search efforts for replacement products, and related spending plans (why advertise an item that is late or short?), expense planning and more.

Over-Communicate: there is a natural tendency to “go quiet” during difficult times. Do the opposite! Speak to your suppliers frequently. Understand the specific challenges they are experiencing and let them know yours. Work on formulating solutions and as circumstances evolve, keep adjusting those solutions. At the same time, when you make consumer-facing adjustments to your offering and operating model, tell your customers why. Be open, be honest and frame the messaging in a positive manner (ex: “in order to continue serving you at the highest level and providing you with compelling products, we have had to temporarily [fill in the blank]).” You can provide the reasons why but don’t share any “woe is me” messaging. The consumer cares about themselves, not you, but will be understanding in most cases.

Freight Opportunities: if you are importing goods directly from Asia, you already understand the immense challenges that exist in getting products to your DC’s and stores. A few options to bring a bit more efficiency to this process include consolidating orders to support full container shipping vs. LCL; using air freight for critical items (this is expensive but may make sense in certain circumstances); and using “fast boats” (also expensive but not as bad as air freight) which can cut about 10 days off average shipping times.

Unfortunately, there are no easy solutions to these challenges. But if you pull as many levers as possible to offset the risk of lost sales and higher costs, the impact on your business will be greatly reduced. But you must start today!

Retail News & Happenings

'Flying off the Shelves': Primark Sales Soar in Reopened Markets

U.S. Consumer Confidence at 16-Month High

What small business owners don't understand about their financials

Amazon’s Top-Selling Product Categories Include…

Peloton Manages High Intensity Growth

How a Broom can Help Measure Leadership Effectiveness

Sam Walton's 10 Secrets to a Successful Business

Cool Pics

Quote of the Week:

“People will sit up and take notice of you if you will sit up and take notice of what makes them sit up and take notice.”

- Harry Selfridge

A random idea: when shopping online, it’s simple to search for an item. Why isn’t the same true in physical stores? Have you ever tried to find a particular bottle of wine in a large liquor store? How about a certain spice in a supermarket or even Costco (those labels are soooooo small)? Has anyone created a solution for this? Hit me up if you know of one. It’s a problem waiting to be solved.

What is the animated explainer video pricing for a video is a very frequent question asked.

https://explainermojo.com/pricing/