Retail Site Selection: Best Practices

Adding stores? Moving locations? Here is how to choose the best sites!

After spending the past 4 weeks doing a deep dive with mall and strip center developers on securing new store sites, it’s clear to me that physical retail is back in a big way. Costs are up and selection is more limited than it has been in years. It seems like the perfect time to write about the basics of retail site selection in case you are ready to open new stores or perhaps relocate one or more of your existing locations.

I also want to touch on an old but tried & true career lesson: the 4 steps of training.

Before you read on, if you are interested in marketing to 7,500 retail decision makers, you should consider advertising here. It’s an inexpensive way to get your offering seen in a very uncluttered ad environment. Click the button to learn more:

Sponsored Content

Are You Challenged with Excess Inventory Tying Up Your Working Capital?

Plan B Distribution helps companies solve their inventory and debt problems. When Plan A doesn't work, then we are your Plan B solution. We have 30 years of experience helping companies with the following challenges:

- Inventory evaluations

- Asset management

- Liquidations, inventory sell-offs

- Logistics

- Warehousing

- 3PL/fulfillment services

- Debt management and more.

Our 500+ customers include banks, VCs, investors, manufacturers, wholesalers, distributors, and both physical and online retailers. We have helped them move over 500,000,000+ units of excess inventory, freeing up both cash and space. We do so under strict confidentiality and control exactly where your product is sold.

Learn more about how we can assist your business with asset disposition, inventory reductions, or logistical challenges. Call Ryan at Plan B, 818-848-6111 or visit www.aplanb.com.

Is your retail business ready to grow via the addition of new locations? Or perhaps you are a DTC business ready to explore physical retailing. Maybe your lease is almost up and you are considering relocating one or more stores.

In each of these scenarios you will need to explore markets that fit your business and then specific locations within those markets. 18 months ago I would have told you that this challenge was magnified by the preponderance of available sites for lease. There were almost too many choices. But the market has changed, and while there are still great options out there, the selection is much smaller. It takes a more focused effort to find them, vet them, and secure them at terms that will work for your business.

So how do you choose? Let’s review how, first from a high level and then from a more detailed perspective.

Identify the Specific Markets You Want to Operate In

Before you begin searching for specific sites, you need to need to identify and prioritize the markets that make the most sense for your business. If you are an existing operator, it may be your current market. But if you are planning an expansion strategy, or if you are new to physical retail, this step is critical.

You can approach this effort in a “top down” or a “bottoms up” manner.

In a “top down” analysis of markets, you will review macroeconomic factors such as population growth, employment rates, leasable retail space, consumer spending, new construction, and other indicators of economic strength. You will also research consumer demographics and psychographics, competition or lack thereof, capacity for new stores, and supply chain efficiencies for your business. This will allow you to identify markets that could be considered for new sites.

Conversely, in the “bottoms up” approach, you will identify potential trade areas that meet your site criteria (same as above). Once identified, you will roll them up into a listing of potential markets. Markets with the most acceptable trade areas will typically be prioritized in your selection process.

I am a fan of the “top down” approach as I find it easier to research, analyze, and compare all of the criteria mentioned above for larger markets versus smaller trade areas. But both can work.

Before we move on to choosing trade areas, let’s dig into a few of the criteria mentioned above.

Population Density & Growth. Simple question: are there enough potential customers in the market being analyzed to make your business successful? It’s also critical to understand if the population is growing or shrinking. Get this information from the landlord, local brokers, chamber of commerce, and local towns and counties.

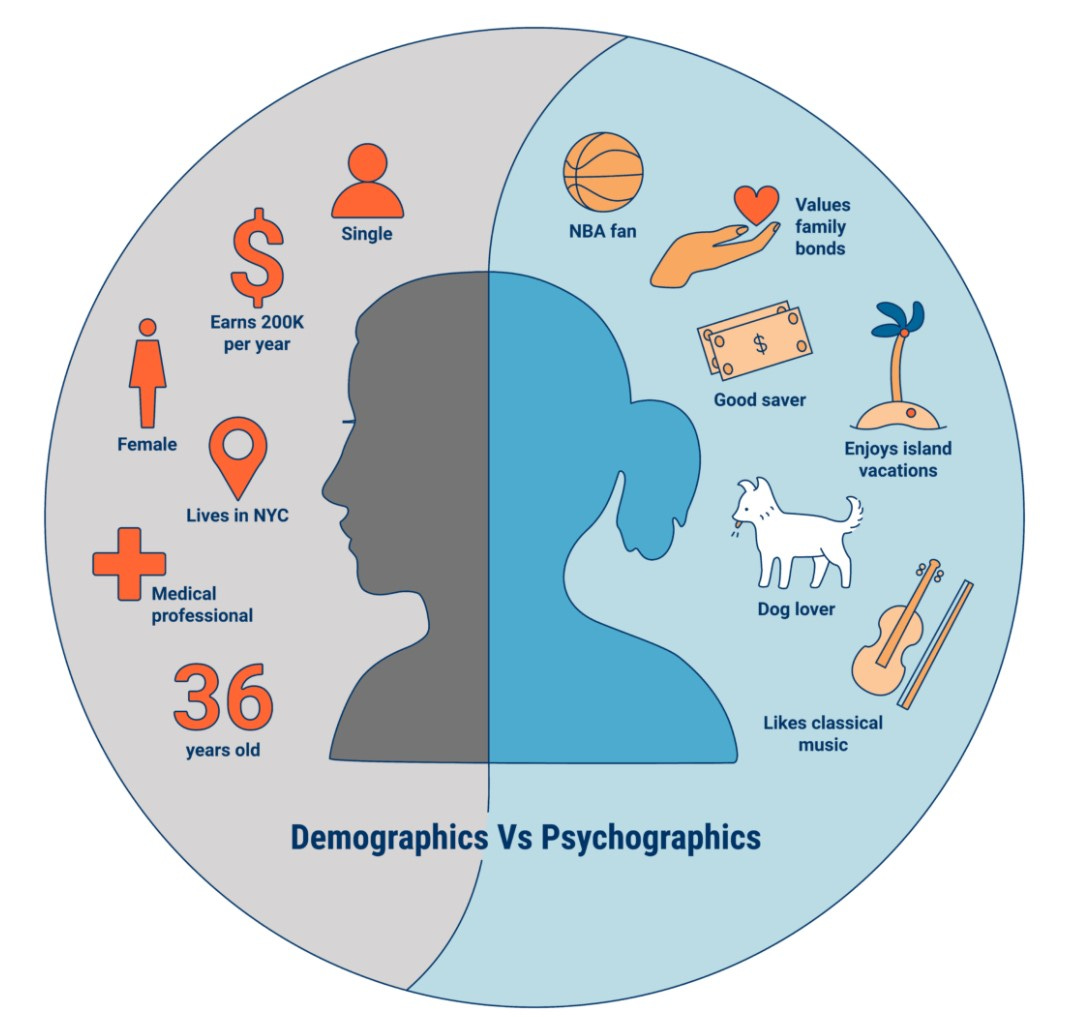

Customer Demographics. While having a meaningful population size in a given market is great, the value is diminished if those people do not match your target customer. This is where demographics come in to play. You must consider factors such as average household income, average age, family size, education level, home ownership, race, religion, nationality, etc. For this step to be effective, it’s vital that you understand your current customer base and their demographic profile.

Customer Psychographics. Psychographic segmentation is tied their behavior, beliefs, lifestyle, and interests. How environmentally conscious is the consumer? What activities does she enjoy? What are her hobbies? Is she health-conscious? Understanding these lifestyle influences will allow you to better understand the potential for your offering to be successful in a specific market.

Within Each Market, Identify Potential Trade Areas

Sticking with the “top down” approach, the next step is identifying trade areas within each market that offer the best potential for your store(s). Historically, trade areas were defined in mileage rings (example: 1 mile, 3 mile, 5 mile), but this no longer reflects the way consumers think or act. Consumers care about how long it takes to travel to a store, so identifying trade areas based on drive-times provides the most useful view.

When evaluating trade areas, use the same criteria you analyzed to choose markets. Population and population growth, employment rates, leasable retail space, consumer spending, new construction, consumer demographics and psychographics, competition or lack thereof, capacity for new stores for you specifically, and supply chain efficiencies for your business should all be considered.

Use this analysis to create some sort of internal rating system which should reflect performance potential by trade area. Perhaps assign a rating (1-10) to each data point and add them all up to determine which areas to prioritize. While this doesn’t have to be complex, having a method of tracking trade area potential will help you as you consider all opportunities.

Identify Potential Sites Within Each Acceptable Trade Area

Once you identify trade areas, it’s time to get very specific and search for potential sites. You may handle this effort internally or outsource the process to a trusted real estate broker (or use a hybrid approach as brokers are great for street and strip sites but less effective for mall, outlet, and lifestyle center opportunities).

You have already conducted a quantitative analysis to determine possible markets and trade areas. As you look at potential sites, it’s time to layer in a qualitative view of each opportunity. Site characteristics to consider include:

Does the site offer the proper mix of co-tenants that will draw shoppers similar to your target customer?

Does the site offer acceptable traffic volumes?

Does the site offer good visibility and ease of access?

Does the site offer appropriate financials (cost of construction, cost of rent) meet your financial objectives?

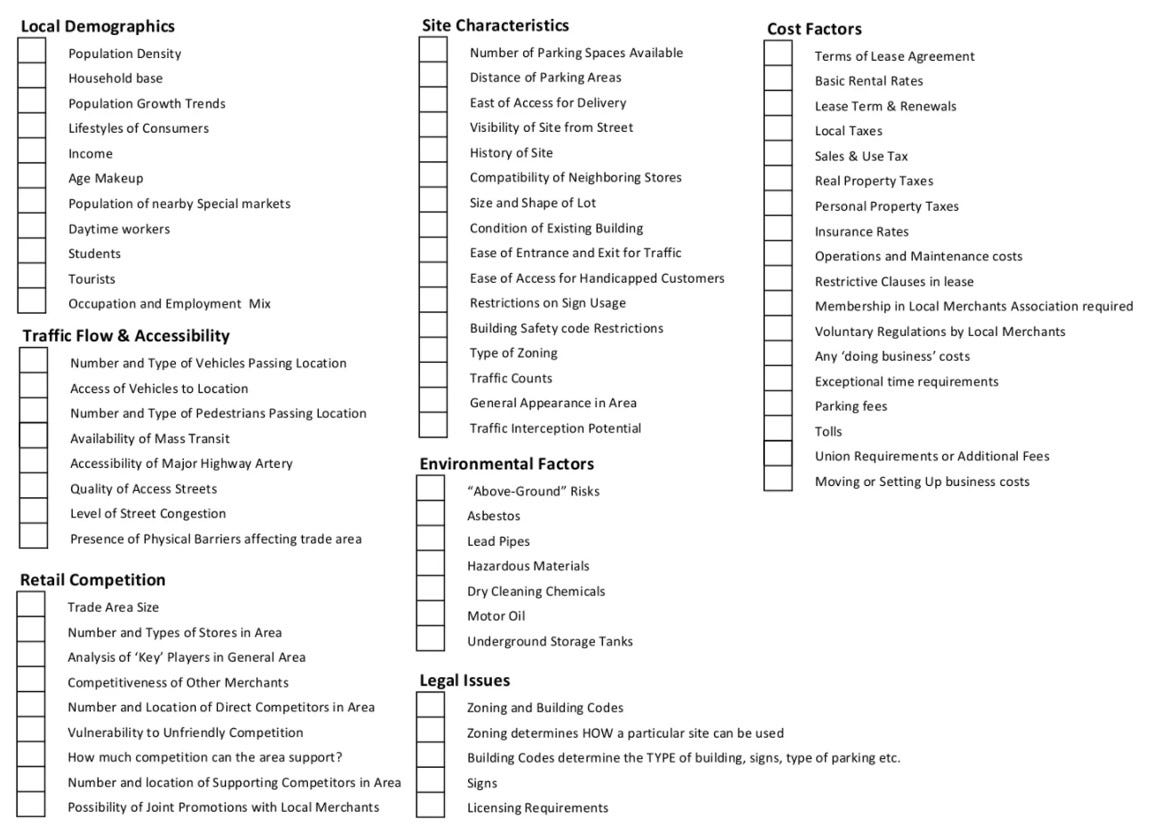

Reviewing sites, of course, requires a deep dive and subsequent comparison of each. The following checklist will help you perform a thorough review of each location you consider.

Site Selection Criteria

As you work the checklist, I suggest an extra focus on these areas:

Location Specifics. These will help you understand how the site works for your specific business as well as how effective it is from an operational and marketing perspective. Review the space size, configuration (will fixtures lay out well?), and frontage (larger/ wider is typically better). Is the space set back somehow from other stores and therefore less visible to shoppers approaching from the right or the left? How large is the exterior sign band? Is the ceiling height too low to create an open and comfortable feeling in the store? Is there rear door access for receiving freight (and a loading dock if needed)? Is there acceptable electrical, water, and HVAC? Are there any obvious ADA issues?

Location Quality. When reviewing specific locations, try to judge its overall quality. How well is it situated within the market? How visible is the site from the road and parking lots? How far is the site from residential areas (convenience is essential for customers as we know)? Can you get placement on pylon signs if they exist for greater visibility?

Location Access. Easy access to your shopping center and/or specific site is critical. Is it easy is it to get in (ingress) and out (egress) of the parking lot? Is the location on the “drive home” side of the main road? Is there a traffic signal to assist people in leaving the location? Is it possible for passersby to easily stop in?

Co-tenant Quality. The co-tenants in a prospective shopping center can have a material impact on your business. Do co-tenants attract similar shoppers? Do they advertise aggressively to draw traffic? Will they encourage cross-shopping (visiting multiple shops) or are they more skewed to “in and out” visits (selling perishables, etc.). Will they use up a disproportionate percentage of available parking spaces? Are there many vacancies within the center?

Traffic Counts & Patterns. Eyeballs count. You want the prospective center and your specific site to be seen as many times as possible. Ideally the site will be on a busy road or intersection, and your location will be within the natural flow of traffic inside the center. If a space is set back, near a dead end in the road, or otherwise off the beaten path, proceed with caution.

Proximity to Competitors. Don’t take this lightly. Identify all direct competitors within the trade area you are considering. Plot their locations as well as the quality center in which they operate and compare both to the site you are considering. Are you out-positioned (will most consumers need to drive by the competition to get to you?) or is the center quality lacking in comparison? Keep in mind that existing competitors have a head start on you in terms of building awareness and a customer base, so your new site needs to be superior to theirs to counter these challenges.

Parking Availability. Will shoppers need to park on the road or in a garage as opposed to a wide open parking lot? Will they need to pay for parking? Is the parking area well-lit, safe and secure at night? Will a particular co-tenant tie up a disproportionate amount of space in the parking area (think drive-thru lines at a Chick-Fil-A)? Convenience rules and you need to ensure shoppers will have it.

Site Economics. This is the final frontier of selecting a site. What are the economics of the deal, do they work for your business model, and can you make money in that spot? Ultimately this may be a deal killer for you if the costs of doing business (after negotiation), are higher than you will accept.

As you consider different sites, use these calculations to help compare and make decisions. Of course, you will need to forecast your sales in each spot as the starting point for this review. Be conservative when doing so!

Cost (Rent) Per Square Foot (cost psf) is the total annual rent cost divided by the total square feet of space.

Cost of Common Area Maintenance (CAM) is typically a separate cost from rent.

Cost of Real Estate Taxes may be an estimate, but must be considered if you, as the tenant, are responsible for them.

Escalation Percentages For Above need to be considered when modeling out year’s 2 and beyond as your lease costs will typically increase.

Other Costs like marketing fees, plan review fees, HVAC fees and similar need to be identified and considered.

Cost of Design & Store Build Out is based on your preliminary budget for a potential site. Your cost of improvements should include both hard costs and soft costs.

Tenant Improvement Allowances & Free Rent can often be negotiated to offset some of your costs related to occupying a new space. Keep in mind that neither may be offered up front but absolutely should be requested by you. Your leverage in requesting one or both of these may be that they will be the tipping point in choosing that site versus another landlord’s site.

Finally, here is a good article on common mistakes made during the site selection process. Click here to read.

There are many tech “solutions” for site selection to aide in this process. They typically can assist in the effort but will not replace the human element. We will cover this in great detail in a future issue.

I have done probably close to 2,000 retail RE deals in my career. These were the best practices I developed over that time.

Career Lessons: The 4 Steps of Training

Effective training of team members, whether new hires or experienced associates learning a new process or procedure, is often lacking. “I don’t have the time to train my people”, “It’s easier to do it myself”, “I told them what to do and they still do it wrong” are all things I hear from retail leaders time and time again. The staffing issues of the past two years have added to the training challenge, as employees are changing jobs more often and in certain situations they are less motivated to learn.

While there are many complex systems which in theory will result in “proper training”, I have relied on a simple 4-step process throughout my career to teach and develop my teams (and I now teach this to my consulting clients). Before you look for a (pricey) silver bullet, give this a try.

Keep reading with a 7-day free trial

Subscribe to All Things Retail to keep reading this post and get 7 days of free access to the full post archives.