I’m sure all of you have heard about the metaverse. Let’s start to dig in to exactly what it is and how it might impact your business over the next few years.

The response to last week’s article on income statements has been great so today I am going to cover balance sheets in a similar fashion. I hope you find it helpful.

Before we do both, a quick reminder about our limited ad & sponsorship program for businesses who are interested in reaching nearly 8,000 retail decision makers. If you want to learn more, or know anyone that might, please click below:

Finally, if you are a free subscriber to All Things Retail, please consider upgrading to a premium subscription. I am confident that the payback you receive from the 100% access to our weekly content will be immense! Click here to upgrade:

Oh yeah…this issue is free for everyone. Next week the paywall returns so think about clicking that button above!!

What is the metaverse?

Well that’s a good question! I have been studying this subject for several months and hopefully the following can help you better understand it. It’s obviously still in its infancy, so how, when, where it’s incorporated into business will certainly evolve. But here is where we are today.

In short, the metaverse takes a 2 dimensional screen and turns it into a 3D digital environment through a combination of augmented reality (AR), virtual reality (VR) and video. People can carry out their daily tasks, such as working, socializing, and shopping, in a digital world.

Who owns the metaverse?

Nobody owns it. Facebook’s name change to Meta was a tactic to take a lead position in leveraging the metaverse, but nothing more than that. Think of the metaverse as more of a concept of how to allow users to engage with your business and in theory build relationships and transact sales with them.

What is the difference between virtual reality (VR) and augmented reality (AR)?

VR is a three-dimensional, computer-generated, immersive environment that users can engage with by wearing a headset or glasses (which are required). AR is a digital overlay that gets projected onto the real world and is brought to life on your digital screen, such as via filters on your phone.

Am I behind the times understanding the metaverse?

In short, nope. Many will say (ex: Zuckerberg) the metaverse is coming sooner than later (or it’s here) and will be a game changer. Nike, Adidas and Forever 21 have already invested in ways to best leverage the metaverse. When companies like these invest in a concept, and media is all over that same space, we all need to pay attention. But trust me, most companies have not come close to understanding the metaverse, never mind how it might help their business and even where to start.

The metaverse concept isn’t terribly complicated. It includes any digital experience on the internet that is immersive, three-dimensional (3D), and ongoing. It is happening 100% digitally and does not exist in the physical word. So far so good?

While we will shop, connect, play, and more in the digital world, physical products (as well as digital products) can be purchased in the metaverse. Every business (or other provider but let’s focus on business here) will design and create their own version of a digital experience, and collectively these become the metaverse. Walmart will most likely have their own digital world as will, for example, Ulta. But they will look, feel, and function completely differently from one another based on the goals and design sensibilities of each individual company.

A handful of gaming businesses have created the base for the metaverse. Major game console and PC games, like Fortnite, have normalized playing and socializing with people in virtual settings. Newer platforms, like Roblox, allow users to play across immersive worlds created, and often monetized, by users. With this base in place, the question now is how quickly will the elements of the metaverse spread across other businesses and other functionalities? More importantly, we will need to learn what consumers will embrace and what they may reject (do you want to, in theory, walk down a virtual aisle in Walmart, with your avatar loading up your shopping cart? Is that meaningful enough for the consumer?).

The vast majority of companies have not acted against the opportunity provided by the metaverse. As they (you) consider doing so, it’s critical to find the proper fit for your business and weigh out the risks and rewards. For many, it may make sense to remain on the sidelines, study the opportunity, watch what happens with the early adopters, and formulate a strategy based on what is learned about the true impact of this immersive, digital world.

One additional point to consider are the tailwinds that the metaverse may enjoy from the growth of social commerce. Consumers are learning to purchase products directly from social experiences, and this channel is projected to have been $36 billion in the U.S. in 2021 once all the cash has been counted. While not exactly the same as shopping on the metaverse, there are enough similarities to potentially overcome any consumer resistance to digital shopping.

So how do you best approach the metaverse? Some thoughts:

Watch existing and new metaverse players:

What is Nike doing? How about Forever 21? How applicable might their ideas be to your business? Perhaps assign a younger (??), more tech savvy team member to lead this research charge and update you every week or so?

Choose your potential path of entry:

Think about your customers. Are they using the metaverse? If so, how? Use this information to begin to form a thesis on how to best approach the metaverse and leverage your existing and target customers.

Identify pre-existing synergies:

Try to determine if the metaverse provides the opportunity for your company to accelerate existing business priorities (ex: sustainability) as you enter the digital world.

When and how will you enter:

Begin formulating an opinion on how your brand should show up in the metaverse and when is the best time to do so. Engage with your team to get different perspectives on this. When you are ready, how will you test properly to mitigate risk?

Be flexible:

The use of the metaverse likely will change and then change some more as users (both businesses and consumers) figure it out. Don’t throw all of your “meta-eggs in one basket”. Try, test, analyze, pivot as needed.

Be creative, very creative:

The metaverse is a palette for creative operators to engage with consumers. The competition will be fierce and unless you offer a compelling digital world with a killer user-experience, you may get left in the dust.

You should always be in a learning mode, as the digital landscape requires intellectual curiosity. It can be confusing and it requires focus to best understand the macro opportunity in addition to how your business may fit in. The metaverse may be the next great version of how we all use the internet to connect, communicate and transact business. Avoiding a deep dive into understanding it could be a pretty significant mistake

Retail Lessons: Small Business Balance Sheet Basics

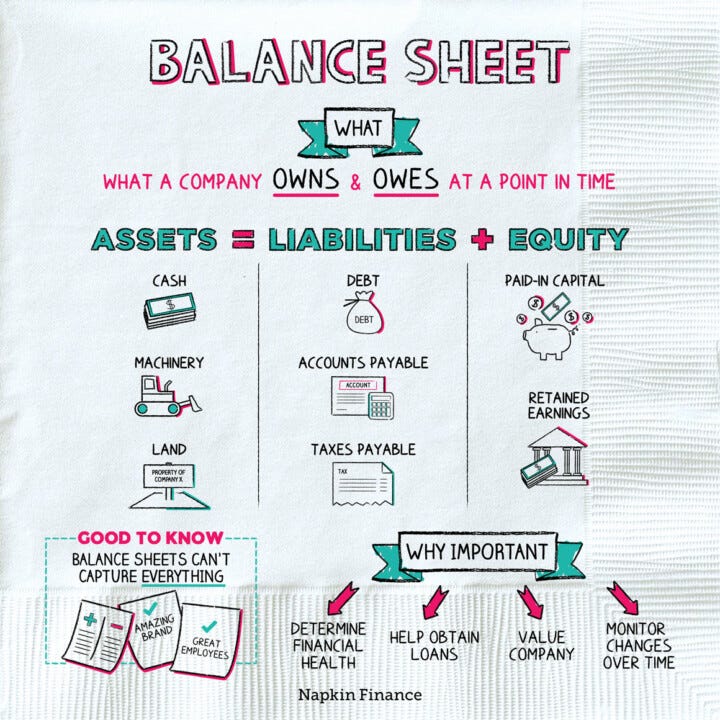

Balance Sheet Definition

I know you work your tail off to make money for your business. Unfortunately, many small - medium business owners don’t put the same effort into properly managing that money once it’s earned. A balance sheet (along with an income statement discussed last week and a cash flow planner discussed last year) is a critical tool in understanding and managing your financial performance.

A balance sheet allows you to lay out your assets, liabilities and owner’s equity in one document. This provides you with an important snapshot of your small business’s finances at a given point in time (usually monthly).

So How Do I Read (or create) a Balance Sheet?

Balance sheets include three sections: assets, liabilities, and shareholders’ equity.

They begin by listing your assets, followed by your liabilities. The final section will be your shareholders’ (owners’) equity. This outline follows the balance sheet formula: Assets = Liabilities + Shareholders’ Equity.

Here are the components of each section of the balance sheet:

Assets. Your assets will include everything your small business owns. This can include cash, inventory, equipment, buildings, land, marketable securities, franchise rights, accounts receivable and even patents and trademarks.

Liabilities. These include what your small business owes to others, such as bank loans, credit card payments, accrued wages -interest-taxes, customer deposits, deferred compensation and accounts payable.

Shareholders’ (Owners’) equity. This is the difference between your assets and your liabilities. This equals the investment or capital that owners have in the business. In other words, shareholders’ equity is what you (and your partners, if any) own after you subtract what you owe from your assets.

The shareholders’ equity section of your balance sheet also will include:

The Par Value of Stock

If your business issues stock, this is the per share amount noted on your business’s stock certificates.

Additional Paid-in Capital

This includes the amount of money paid by your stockholders for their shares of your business’s stock.

Your Retained Earnings

This includes your business’s net income from inception until the current date. Your business’s dividends, if any, are deducted from these earnings.

In addition to the data above, balance sheets should compare your current balances with the balances from a prior period to help identify trends, good or bad, in the business.

Use the link below to see an example of a balance sheet and to download, if you like, a template for future use.

Microsoft Excel Balance Sheet Template

4 Important Balance Sheet Financial Ratios

So once the data is complete and accurate, how do you best use it to understand the health of your business? Use these basic financial ratios to see where you stand.

Current Ratio

The current ratio (also called the working capital ratio) measures a company's ability to meet its short-term debt obligations using its current assets. It indicates how many times current liabilities can be covered by current assets, making it an effective measure of a company's liquidity. In general, a good current ratio is anything over 1, with 1.5 to 2 being the ideal.

Current Ratio = Current Assets / Current Liabilities

Quick Ratio

The quick ratio gauges a company's ability to cover its current liabilities using only its most liquid assets. It indicates how many times the company's current liabilities can be covered by its most liquid assets such as cash, cash equivalents, and marketable securities. It’s a bit more conservative that the current ratio. Again, target a quick of over 1.

QR = (Current Assets - Inventories - Prepaid Expenses) / Current Liabilities, or

QR = (Cash + Cash Equivalents + Marketable Securities + Accounts Receivable) / Current Liabilities

Cash Ratio

The cash ratio measures a company’s ability to pay its current liabilities using only its cash and cash equivalents. The cash ratio indicates how many times the company’s cash and cash equivalents can cover its current liabilities.

Cash ratio = (Cash + Marketable Securities) / Current Liabilities

Debt Ratio

The debt ratio measures a company’s debt relative to its assets, providing valuable insights into how assets are funded and the degree to which its assets can be used to cover financial obligations. A value greater than 1 indicates that the company has more debt than assets, where a value less than 1 indicates that it has more assets than debt.

Debt Ratio = Total Liabilities / Total Assets

Balance Sheet vs. Income Statement

As discussed last week, your balance sheet reports your business’s overall financial health by providing a snapshot of your financial position at a certain point in time, while your income statement reflects your overall financial performance across a period of time. The two documents work hand in hand to communicate key financial information to your shareholders, investors, and customers, as well as to ownership.

Your balance sheet can show the direction of your business’s financial health. The more time, energy, and thought you put into creating and analyzing your balance sheet, the more actionable information you’ll be able to glean from it—all of which can help ensure that your business will grow in the future.

Retail News You Can Use:

What the metaverse could mean for retailers

Here's what your mall will look like in the metaverse

Journey through the metaverse: Is the future of retail virtual?

Top five retail trends to watch in the new year

Walmart expanding grocery delivery inside customer homes to 30 million homes

Achieving supply-chain resiliency in consumer goods amid disruption

The retail supply chain is hot, hot, hot

How incumbents survive and thrive

How to maintain your mojo this year

Cool Pics:

Sponsored Content

Quotes of the Week:

"It is not necessary to do extraordinary things to get extraordinary results." -- Warren Buffett

"I'm convinced that about half of what separates the successful entrepreneurs from the non-successful ones is pure perseverance." -- Steve Jobs

"Whenever I meet a successful CEO, I ask them how they did it. Mediocre CEOs point to their brilliant strategic moves or their intuitive business sense or a variety of other self-congratulatory explanations. The great CEOs tend to be remarkably consistent in their answers: They all say, 'I didn't quit.' -- Ben Horowitz