Is Cash Flow More Important Than Profit?

We all know profit is critical, but more businesses have failed from cash flow issues than any other reason. Cash is king!

I know it’s hard to focus on anything other than the holiday selling season right now. But it’s important that some thought is given to 2022 without creating too much of a distraction to selling product and satisfying customers. With the turn of the year approaching, the discussion of cash flow is vital. Revenue will slow, invoices will be due, and expenses as a percentage of sales will grow. Take a bit of time, read this issue and begin to plan accordingly.

Be sure to jump down to “Empty Chair”. It’s a quick but a very cool perspective on customers.

Finally, I just set up landing page with my favorite book recommendations from this year. I usually share it internally with my network but thought I should share it here. Click the button to check it out:

Why do we own or operate a business? To generate profits!

Right??

Well, kind of.

While profits are the “end goal”, having sufficient cash to attain that goal is an absolute must.

I have worked for companies (three separate large-scale turnarounds) and with clients that were highly challenged, sometimes bordering on bankruptcy. In many cases they were growing and even showed a profit on paper. So, what was the issue? Lack of cash, usually due to poor cash flow management. When we fixed how cash flow was forecasted and managed, we basically fixed the business.

I understand this may seem obvious to many, but it consistently shocks me how many business leaders that should know better simply do not pay sufficient attention to their cash flow. So, while these may seem like basics, let’s dig into the subject of cash flow.

So, what is cash flow management exactly?

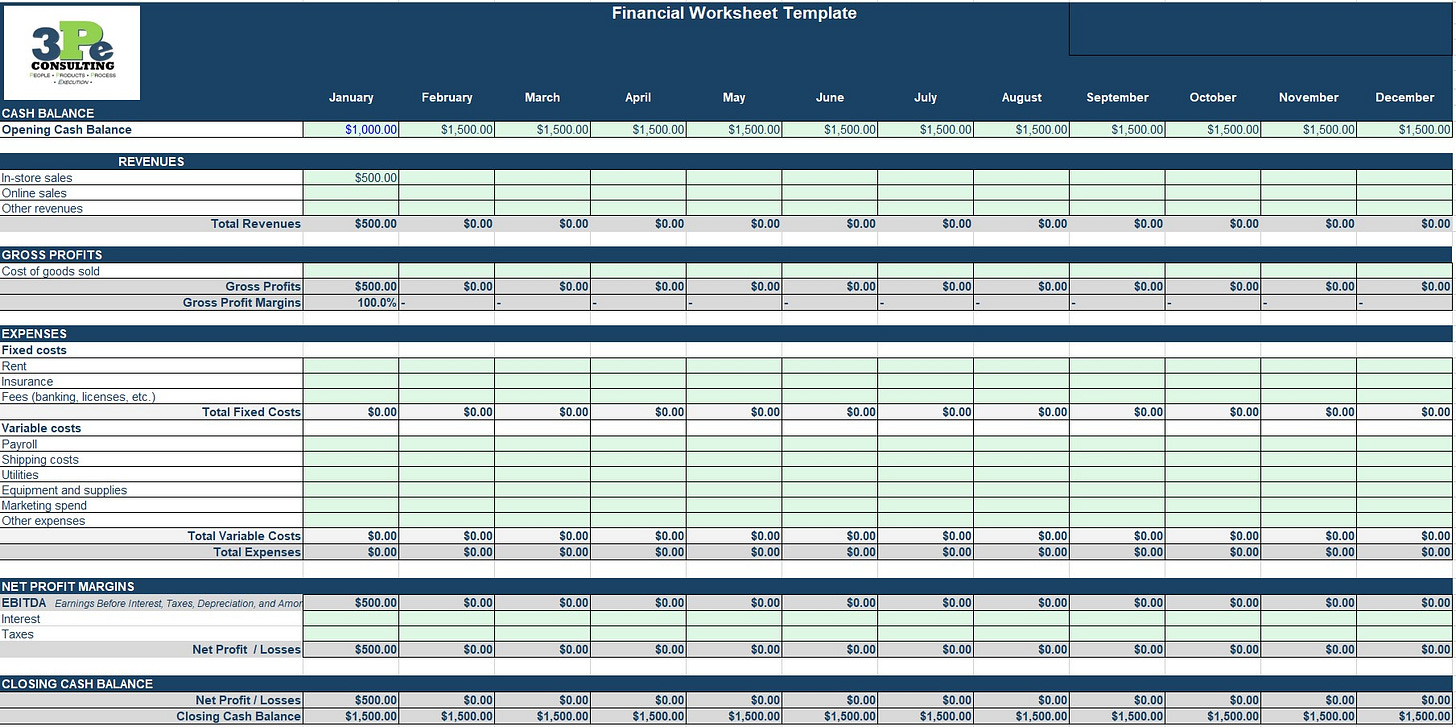

Cash flow is the amount of money flowing into and out of a business on a day to day, week to week and month to month basis. A positive cash flow means more money is coming into the business than going out (a good thing), and a negative cash flow means less money is coming in than the business needs to cover outbound cash (a bad thing and significant risk).

To calculate cash flow, you track the cash available at the beginning and at the end of a specific period (week or month, but the more often the better). Your expectation should be to have more in the account at the end of the period than when the period began (again, positive cash flow). If you have less cash at the end of a given period, your cash flow is negative and red flags should fly. If this negative cash flow continues period after period, you are depleting (or “burning”) your money and you will eventually run out. This kills businesses more often than any other factor. Hence the saying “Cash is King”.

Keep reading with a 7-day free trial

Subscribe to All Things Retail to keep reading this post and get 7 days of free access to the full post archives.