Hey all! Gotta ask a favor. My goal is to add another 1,000 subscribers in the next month, and I need your help. Nearly 8,000 retailers and retail service providers have signed up for All Things Retail since we launched in April. Join them as they leverage our easy to implement ideas and advice to help grow their businesses. Subscribe now and every new issue of the newsletter will go directly to your inbox weekly on Tuesday mornings. A typical issue is about a 7 minute read, a small investment for a big return! If you have not subscribed yet, you can here:

$0 to $200 Million in 18 Months; a Toys R Us Pop-Up Program Case Study

In Issue # 4 of All Things Retail, I discussed Pop-Up Stores and the opportunity they present for retailers, digital merchants, and manufacturers (and no, it’s not too late to execute a pop-up program in 2021. Hit me up and I’ll explain). Based on the great feedback, I thought it would be interesting to write a case study of a successful pop-up initiative, Toys R Us Express.

When I went to Toys R Us, first as a consultant and then as the head of specialty retail, they did not have a pop-up model developed. My challenge was to create the concept, test it to gain proof of concept, and scale it aggressively. Long story short, we opened 700 stores and grew revenue from $0 to $200 million in 18 months. Mission accomplished!

Let’s dig in to the details!

The Situation:

KB Toys had its funding pulled during the credit crisis of 2008 and was forced to close. This left malls and outlet centers without any toy offering. Almost $1 billion of market share was up for grabs.

TRU was not opening many big box stores, yet it needed a growth story to support its pending potential IPO.

TRU needed to find a way to grow without committing significant capital, as they were burdened with a heavy debt load.

TRU wanted to create a barrier to new competitors rising and grabbing some or all of KB’s market share.

While pop-up stores were lower volume than big box stores, the unit count growth would be eye-catching, volume/ EBITDA was solid, the capital investment would be negligible, and the risk was almost non-existent.

So, let’s go!

The Objectives:

Test the concept with 30 stores year one and expand dramatically year two.

Protect the TRU Brand. These small box, low cost, temporary stores would need to support the Toys R Us image and guest experience.

Avoid cannibalizing sales from big box TRU stores. Our program had to be accretive to the organization.

Do not become a distraction to the core TRU corporate and field teams. They had their own jobs to do.

As an offshoot of this initiative, define the potential for permanent small box stores, with outlets being at the top of the list.

Build the program to $100MM+ (we 2X’d that target).

Internally, the sensitivities that this project may become disruptive to the TRU team were immense. My small team (3 people) and I needed to tread carefully and be very tactical to meet all deliverables.

The Challenges:

Teaching the TRU team the nuances of small box retailing in a short period of time.

Developing acceptable financial and operating plans.

Creating a store design that would meet Toys R Us branding expectations while being low cost, easy to set up and take down, easy to store off-season, and capable of holding enough inventory to support annualized revenue targets of $1.2 million or more.

Developing an assortment plan to meet sales & gross margin goals. Toys R Us ran on lower margins, so we needed to source about 20% of the assortment outside of their mix to provide enough higher margin product.

Opening a pilot store very quickly to create proof of concept. We had our first store open within 3 months.

Securing quality store sites at scale and at acceptable occupancy costs in a short window of time.

Hiring & Training Store Teams. Most Express stores were managed a Toys R Us team member (usually a big box assistant manager) and the remainder of the staff was hired off the street.

Executing our plan nationwide. This included store openings (permits, buildout, stocking, tech stack), store operations (staffing, training, selling, maintenance, loss protection), inventory replenishment, marketing, planning end-of-lease closures, and more.

What We Accomplished:

The pilot store’s look, feel, costs and early sales results were great. So, our store count goal for the year was increased from 30 to 100. We were able to get 89 open.

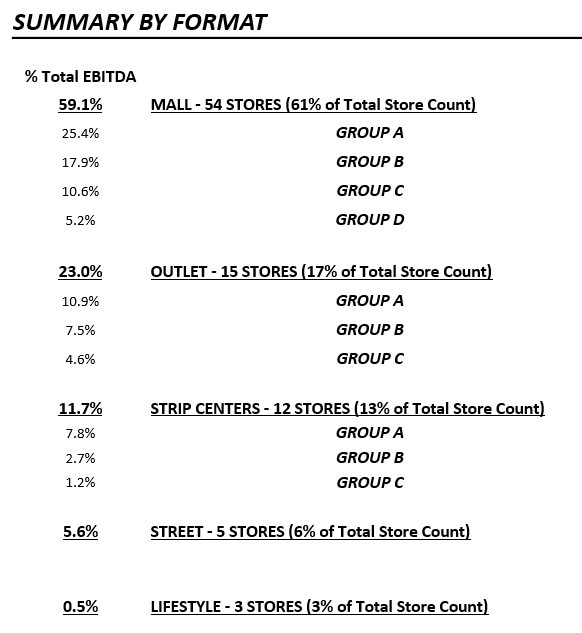

We secured spaces in all kinds of locations, from malls and outlets to strip centers, urban street locations, lifestyle developments and even transportation hubs.

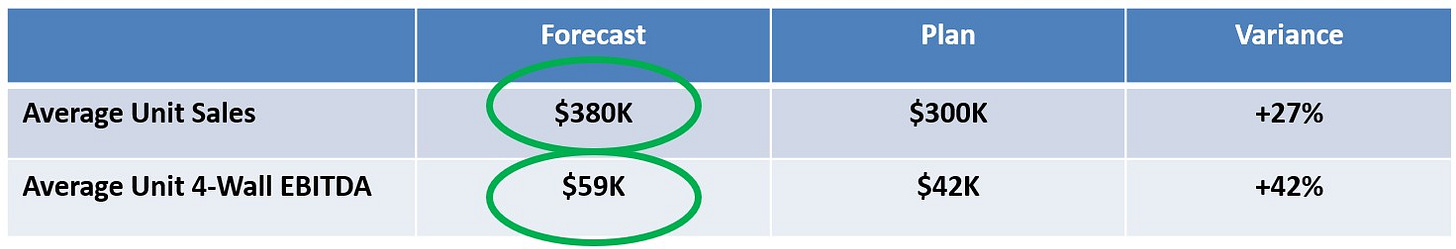

Sales and 4-wall contribution were well above plan for the year. The combination of robust revenue (the customer loved the concept, its offering and the convenience our locations provided), solid gross margins and tight cost controls worked.

We found, when a pop-up was located close to a big box TRU, it was accretive to sales for the big box. Why? Our teams directed customers to the big box stores when we did not have an item, and we sold a ton of gift cards, which were typically redeemed in the big box.

30 stores remained open and profitable into 2010. Most toy stores lose money every month except November and December. We proved that pop-ups can be profitable all year long. Look at February, which is a weak toy retail month:

Based on the first year success, we opened 607 pop-up stores in year two. Most performed very well, but there were a few bad locations. 70 of the 607 remained open and profitable in 2011, lending further credibility to the strength of the pop-up model.

As part of the second year rollout, we designed and opened several FAO Schwarz pop-up stores in higher income communities.

It was clear the small box concept clearly had a place inside TRU. Therefore, we designed and opened the first-ever permanent TRU Outlet Stores in 2010. This concept was also very successful, growing to about 60 locations over time.

The Learnings:

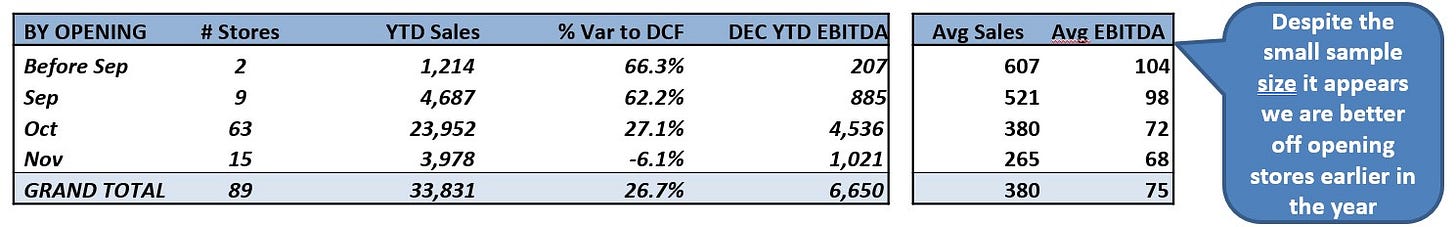

Opening earlier tended to produce better results. Many would think being open in just November and December (the two historically profitable months of the year) would make the most sense, but our data showed otherwise. This was due, in part, to the need to build consumer awareness.

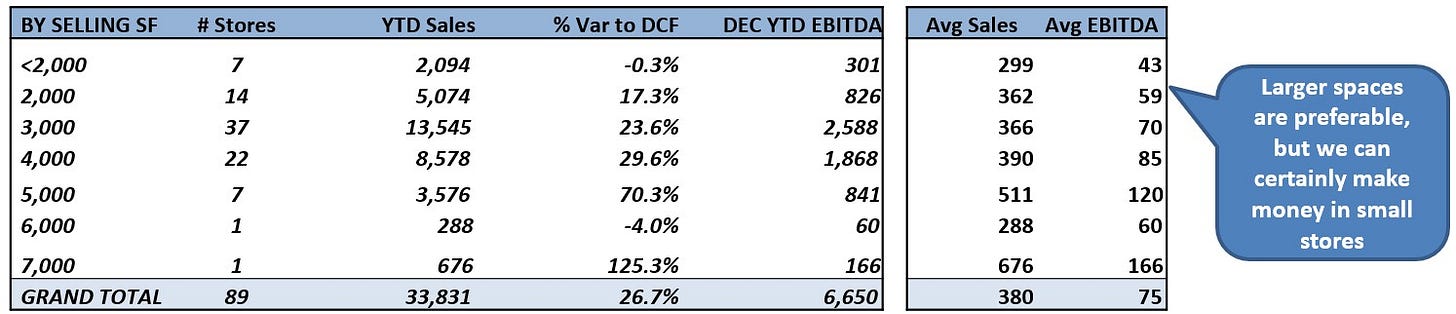

Despite the potential for higher occupancy costs, larger stores tended to return more than smaller ones. Inventory capacity and ease of shopping were two of the reasons why.

Outlet Centers delivered the greatest EBITDA return relative to store count, while Lifestyle Centers were the worst.

Gift Card sales were a must. They helped avoid shoppers leaving the stores empty handed and they were redeemed for well more than face value.

The 80/20 rule applied to the assortment plan.

Despite the challenges, our temporary store initiative proved, without a doubt, that properly planned and executed, pop-up programs can be highly profitable, even off-season.

Retail News & Happenings

Working Backwards: Amazon’s Approach to Innovation

How Our Favorite ‘90s Brands Made Modern Comebacks

Scale Or Fail: How Incumbents Can Industrialize New-Business Building

Google’s CMO Shares 5 Enduring Lessons the Pandemic Has Taught Her

Walmart Unveils All-in-One Associate App, and Gives 740,000 Associates a New Samsung Smartphone

How Chewy Charmed Pets, Owners, And Investors To Become A Fortune 500 Company

9 Experiential Retail Trends (and Case Studies)

Quote of the Week:

“You can have a phenomenal technology with bad people; you're not gonna have much success. You can have mediocre technology with great people; they'll figure out a way to make a buck.”

- Ken Langone, Co-founder Home Depot